Incoterms are like the traffic lights of global commerce: they keep things moving smoothly, preventing misunderstandings.

International shipping can be complex, with various challenges and rewards. To ensure a smooth logistics operation, stakeholders use Incoterms, a global shipping language that outlines the journey of goods from factory to doorstep.

The shipping terms range from Delivered Duty Paid (DDP) to Ex Works (EXW), and choosing the right one depends on the specific requirements of the buyer and seller.

Understanding Incoterms is essential for stakeholders to know their responsibility and ensure a hitch-free logistics process.

In this blog post, we discuss:

· What is DDP?

· How does DDP apply to businesses?

· DDP vs. EXW vs DAP

· What are Incoterms?

· Types of Incoterms

· Who gets to decide on the Incoterms?

· How can OPLOG assist you?

What is DDP?

DDP stands for Delivered Duty Paid, an Incoterm that defines the responsibilities and risks of buyers and sellers in international trade.

Under DDP, the seller is responsible for delivering the goods to the buyer’s place of destination and paying for all the costs and duties involved in the transportation and clearance of the goods.

DDP is the most favorable term for the buyer, as it transfers all the risks and obligations from the seller to the buyer. The buyer does not have to worry about additional charges or delays in delivering the goods, as the seller bears all the consequences. The buyer only has to pay the agreed price for the goods and receive them at the specified location.

However, DDP is also the most unfavorable term for the seller, as it exposes the seller to the highest level of risk and liability. The seller has to deal with the customs and regulations of both the exporting and importing countries, as well as arrange for the insurance and transportation of the goods.

The seller also has to bear the costs of any damages or losses that may occur during the goods' transit. Therefore, the seller should only use DDP when they have high trust and confidence in the buyer and the destination country.

How does DDP apply to businesses?

DDP puts most logistics responsibility on the seller, with the buyer only having to pay and receive goods. Handling the logistics process in-house can make DDP a daunting task for sellers due to the many rules and regulations that govern international trade.

As a seller:

Partnering with a fulfillment partner would be the best option, as the 3PL fulfillment company takes care of picking up items, packaging them, and moving them to the desired countries.

When partial shipping is needed, shipping items in less-than-container load (LCL) is more accessible.

Offering DDP can make business more appealing to international buyers who value convenience and predictability. Additionally, you have more control over the delivery process as you get to choose the carrier and can track the shipment progress.

As a buyer/retailer:

Opting for DDP significantly reduces the number of logistics operations you need to handle. However, you lose some degree of control over the shipping processes. This is because, in DDP, you depend on the seller to manage the entire logistics process efficiently.

This can be a significant challenge, especially when working with a seller for the first time and needing to gain prior knowledge or experience of their logistics prowess.

In such cases, it is essential to make an extra effort to ensure that the seller can deliver the products on time and in the proper condition. You may also need to communicate your expectations clearly and establish a good working relationship with the seller to minimize risks and uncertainties.

For complete control over shipping processes, the best option would be EXW. More on this later.

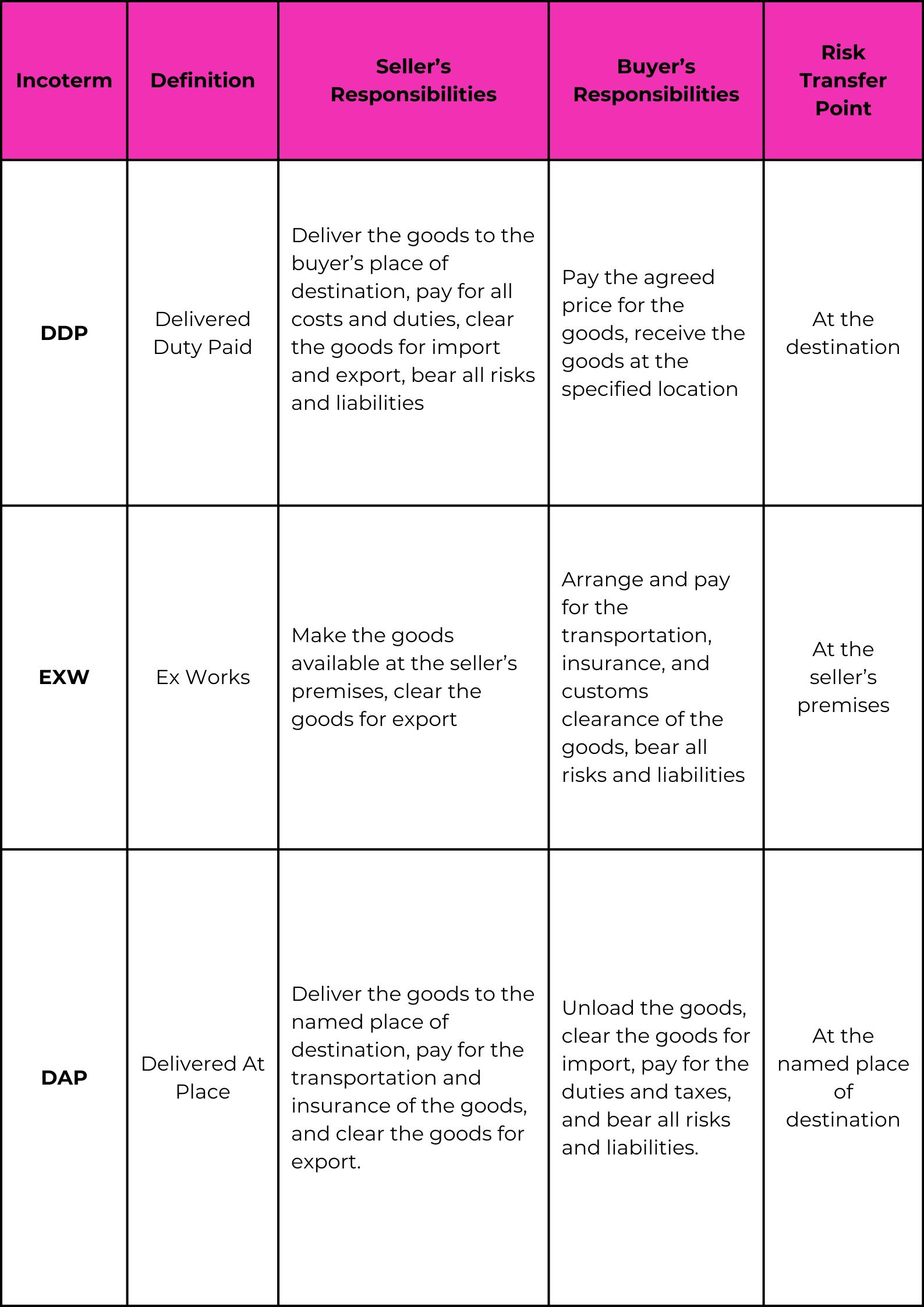

DDP vs. EXW vs. DAP

How does DDP compare to EXW and DAP? These three incoterms share the responsibilities required of the buyers and sellers.

While DDP shifts most duties to the seller, EXW does the complete opposite, and it is commonly used during domestic trade.

It’s challenging to implement in international trade because the buyer has to manage the loading and export formalities in a different country with unfamiliar trade laws.

DAP is somewhere in between: it splits the costs and risks between the seller and the buyer.

Here’s a table highlighting the key differences.

What are Incoterms?

Incoterms are commercial terms used in international trade contracts and shipping documents that outline the responsibilities and risks of buyers and sellers in cross-border transactions.

There are 11 Incoterms in the latest version (2020), divided into two categories:

· Rules for any mode of transport.

· Rules for sea and inland waterway transport.

Let us use a practical example to give a perspective of how Incoterms work. Suppose a company in the Netherlands wants to buy 100 laptops from a supplier in China. They agree on the following terms:

· The price of the laptops is USD 50,000

· The Incoterm is DAP (Delivered at Place)

· The place of destination is the buyer’s warehouse in Amsterdam

· The seller is responsible for delivering the goods to the buyer’s warehouse, ready for unloading and clearing them for export

· The buyer is responsible for unloading the goods, clearing them for import, and paying for the duties and taxes

· The risk of loss or damage to the goods transfers from the seller to the buyer when the goods are available for unloading at the buyer’s warehouse

In this example, the seller would have to pack the laptops, transport them to the port of Shanghai, complete the export formalities, ship them to Amsterdam, and arrange local inland transport to the buyer’s warehouse.

The buyer would have to unload the goods from the truck, complete the import formalities, and pay customs duties and taxes. If the goods are damaged or lost during the transit or unloading, the buyer must bear the loss or claim the insurance.

Types of Incoterms

Incoterms have different implications for the stakeholders' costs, risks, and obligations.

EXW (Ex Works): The seller delivers the goods at their premises or another named place, and the buyer bears all risks and costs involved in transporting the goods to the desired destination.

FCA (Free Carrier): The seller delivers the goods to the carrier or another person nominated by the buyer at the seller’s premises or another named place, and the buyer bears all risks and costs after the delivery.

CPT (Carriage Paid To): The seller delivers the goods to the carrier, or another person chosen by the seller at an agreed place and pays the carriage costs to bring the goods to the named destination. The buyer bears all risks of loss or damage to the goods from the point of delivery.

CIP (Carriage and Insurance Paid To): The seller is responsible for delivering the goods to a carrier or any other individual nominated by the seller at a pre-agreed location. The seller must also bear the cost of carriage and insurance to take the goods to the designated destination. Moreover, the seller is accountable for insuring the goods during transit. However, the buyer assumes all risks of loss or damage to the goods once delivered.

DAP (Delivered at Place): The seller is responsible for delivering the goods to the buyer at the specified destination. This includes placing the goods at the buyer's disposal on the arriving means of transport and ensuring they are ready for unloading at the named place. The seller is accountable for all risks associated with transporting the goods to the named place.

DPU (Delivered at Place Unloaded): When a seller delivers goods to a buyer, the risk is transferred to the buyer once the goods are unloaded from the means of transport and made available at the agreed-upon destination. The seller is responsible for all associated costs and risks of transporting and unloading the goods at the destination.

DDP (Delivered Duty Paid): The seller is responsible for delivering the goods to the buyer. This means they must make the goods available to the buyer at the named destination. The goods must be cleared for import and be ready for unloading upon arrival. The seller is responsible for all the costs and risks involved in bringing the goods to the place of destination. This includes the cost of transporting the goods and any fees associated with clearing the goods for export and import.

FAS (Free Alongside Ship): The responsibility of delivering the goods lies with the seller until they are placed alongside the vessel at the named port of shipment. This means the seller is accountable for any costs and risks of damage or loss to the goods until that point. However, once the goods are placed alongside the vessel, the buyer must bear all costs and risks of loss or damage to the goods from that point onwards.

FOB (Free on Board): The seller is responsible for delivering the goods on board the vessel nominated by the buyer at the named port of shipment. Alternatively, the seller may procure the goods already delivered to the vessel. Until the goods are on board, the seller bears all the risks of loss or damage. From that point onwards, the buyer bears all the costs and risks of loss or damage to the goods.

CFR (Cost and Freight): The seller contracts for and pays the costs and freight necessary to bring the goods to the named destination port. The buyer bears all risks of loss or damage to the goods from the point of delivery.

CIF (Cost, Insurance, and Freight): The seller contracts for and pays the costs, freight, and insurance necessary to bring the goods to the named destination port. The seller also contracts for insurance cover against the buyer’s risk of loss or damage to the goods during the carriage. The buyer bears all risks of loss or damage to the goods from the point of delivery.

Who gets to decide on the Incoterms?

It is important to note that Incoterms should not be chosen by one party alone. Instead, both parties—the buyer and seller—should engage in a joint decision-making process through negotiation and agreement to determine the most suitable Incoterms for their needs and interests.

Certain Incoterms may be more advantageous for the buyer or seller, depending on the situation. For instance, EXW (Ex Works) is the most favorable term for the seller, as it transfers all costs and risks to the buyer once the goods are available at the seller's premises.

On the other hand, DDP (Delivered Duty Paid) is the most advantageous term for the buyer, as it transfers all costs and risks to the seller until the goods are delivered to the agreed destination.

Therefore, it is crucial that buyers and sellers carefully evaluate the pros and cons of each Incoterm before settling on one. Specify the version of the Incoterms as listed in Incoterms 2020. By doing so, you avoid any confusion or disputes arising from differing interpretations or expectations.

How can OPLOG assist you?

It could be tricky balancing international logistics, business expansion, and revenue growth. It gets trickier when you throw in shipping options and how they work.

OPLOG has a team of fulfillment specialists who can help you choose the most appropriate Incoterm based on specific requirements, trade routes, and product types.

Our global omnichannel fulfillment network handles transportation, customs clearance, and deliveries, so you spend less time on fulfillment and shipping and more on capturing new markets across different locations.

Moreover, we use technology to finesse your supply chain operations from suppliers to warehousing and set last-mile delivery standards.

Do you need to get started with international shipping? Let's talk.